October 2024

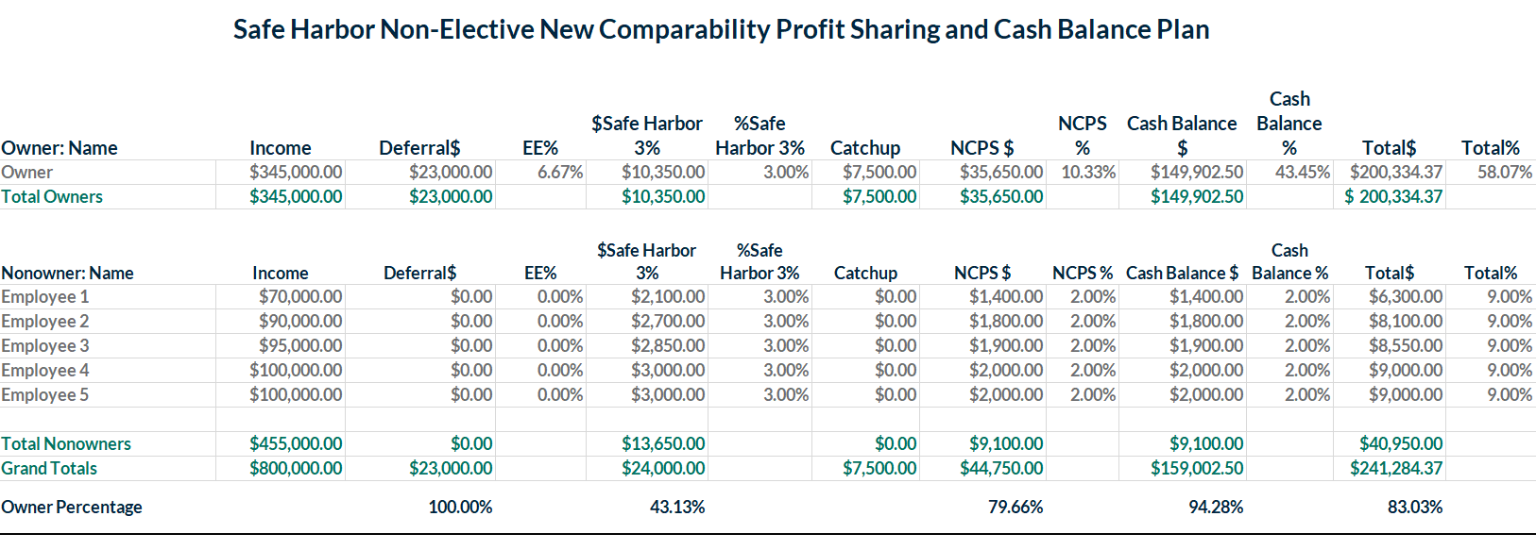

Blending the best features of traditional pensions and 401(k) plans, cash balance plans offer predictable retirement income, tax advantages, and investment flexibility. That said, navigating the setup and administration of these plans can be complex. That’s where we come in. The WPWealth team will guide you through every step, ensuring compliance, optimizing benefits, and aligning the plan with your financial goals. Continue reading for further insights.

Should Your Company Consider a Cash Balance Plan?

Your company may be a good candidate for a cash balance plan if it meets the following criteria:

What Are the Characteristics of a Cash Balance Plan?

- The contribution is specified within the Plan Document

- More flexibility allocating benefits to different employee groups

- Contributions placed in a “Hypothetical Account” for participants yearly

- Fixed Annual Credit and Fixed Annual Interest Credit on the account

- Plan guarantees a benefit amount, providing security

- The plan offers you significant tax-deferred savings opportunities

- Allow for significantly larger contributions than a 401(k) plan alone

- Plan sponsor bears investment risk, not employees

- Contributions must be Fully Vested after three years

- Should be maintained for 5 years, per Permanency requirements

- Plan Assets are pooled and trustee-directed

Get in Touch

We will work closely with you to tailor cash benefit plans, maximizing their potential benefits and aligning them with your long-term financial goals. Reach out to see how we can help you make your retirement goals reality.